AVIXA’s Industry Outlook and Trends Analysis (IOTA) is out!

The latest AVIXA IOTA report paints a steady, realistic picture of the Pro AV Market over the next five years. Growth is still on – just more measured than last year’s hype cycle. As Sean Wargo, AVIXA’s VP of Market Insight, puts it:

“The pro AV industry remains well-positioned for long-term success even as we navigate a more cautious growth environment. Strategic investment in emerging technologies, regional diversification, and cross-industry collaborations will be key to unlocking more opportunities in the future”

What the new report says

1) The headline numbers

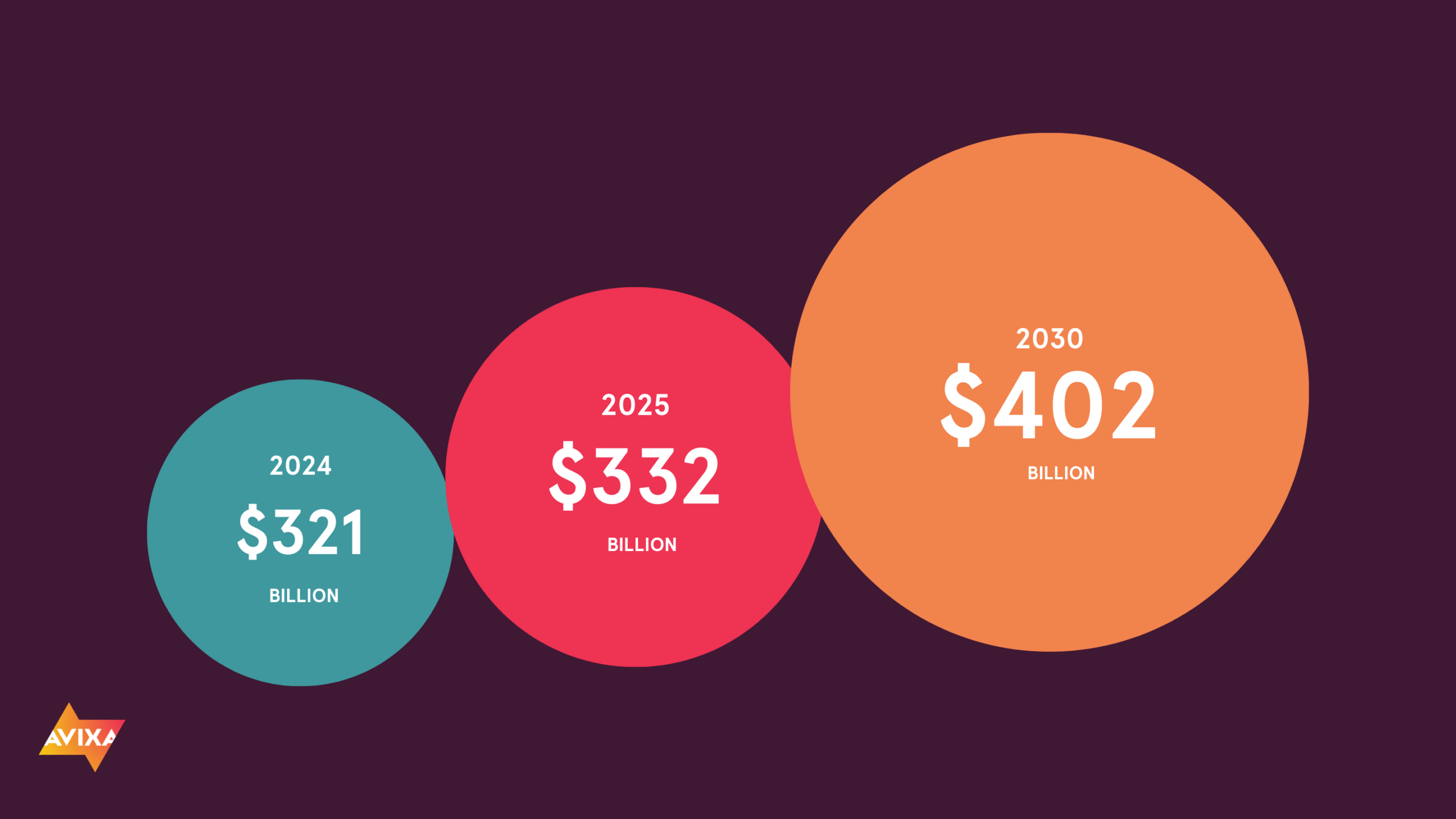

- Global Pro AV revenue is estimated at $332B in 2025, tracking toward ~$402B by 2030.

- 2024 closed a touch below earlier expectations, so the long-range growth rate has been trimmed – but AV is still projected to outpace global GDP through the period.

2) What’s driving demand

- Two big engines: the hybrid workplace (reliable, inclusive meeting experiences) and the experience economy (events, venues, retail, visitor spaces).

- Under the hood: According to AVIXA, the pro AV industry also continues to evolve through innovations in AV experiences. Key innovations are four technologies: AV-over-IP, software and cloud, artificial intelligence (AI), and extended reality (XR).

3) Where the money is going (solutions & verticals)

- Conferencing & collaboration remains #1.

- Broadcast/content creation has leapt to #2 as organisations produce and distribute more video internally and externally.

- Security/surveillance is climbing, tied to analytics and operations.

- Corporate is still the largest buyer, but government/military and energy & utilities are accelerating and are more resilient during slowdowns.

4) Regions to watch

- APAC is the growth engine. India stands out within the APAC region, with strong infrastructure and immersive tech demand.

- Middle East and Latin America also show healthy momentum.

Bottom line

AV is evolving from project-by-project installs to networked, measurable, secure estates. Organisations that standardise, monitor, and manage their AV like any other IT workload will see the best uptime and the strongest ROI.

Conclusion: Why this outlook matches our playbook at Online Instruments

At Online Instruments, we saw this shift early and built our roadmap around it. With India emerging as APAC’s growth engine, we’re expanding our capacity and delivery while scaling presence across the Middle East, Southeast Asia and America, and progressing a strategic acquisition to add capabilities and client coverage in new markets. This isn’t growth for growth’s sake – it’s how we give enterprise customers consistent experiences across regions, faster rollouts, and better lifecycle economics.

The IOTA findings confirm what we’ve been building toward: a pro AV future that’s software-defined, data-driven, and outcome-focused. That’s why we’re expanding – organically and via acquisition to help customers modernise faster and to lift the wider AV ecosystem with better processes, training, and repeatable excellence.